Coversol Solar Investments secures mezzanine financing for the construction of a 29 MWp C&I solar rooftop portfolio in Italy

Coversol Solar Investments GmbH (“CSI”) successfully secured a junior debt facility for a portfolio of rooftop PV systems on commercial and industrial (C&I) buildings with a total capacity of 29 MWp (“Coversol 1”) in Italy. The funds are being provided by Energy Transition International Capital (“ETIC”) acting on behalf of the Energy Transition Europe fund. The company recently reached financial close for the senior debt package with a club consisting of Crédit Agricole Transitions & Energies through Unifergie, its financing arm and BPCE Energeco (a branch of BPCE LEASE) for the bespoke portfolio and is now with the closing of the entire financing structure for the Coversol 1 portfolio. Capcora accompanied CSI as a financial advisor.

The portfolio is one of the largest of its kind in Italy, consisting of over 44 photovoltaic rooftop installations, mainly located in Piedmont, with a combined energy generation capacity with 7 MWp in operation and 15 MWp under construction. All projects will be operated under the Italian “FER1” Contract for Difference incentive scheme securing a 20-year feed-in tariff. Part of the production will be sold under on-site PPAs.

The Energy Transition Europe fund is investing €6 million on the level of a newly founded HoldCo to recapitalize the equity of CSI bound in the portfolio. The total financing package including the senior financing amounts to €25m.

The purpose of this transaction is to help release equity for the construction of new energy production capabilities in Italy under a similar scheme. CSI is developing additional portfolios for energy-intensive industries and energy communities: It has over 125 MWp under development and targets 1+ GW in operation by 2030.

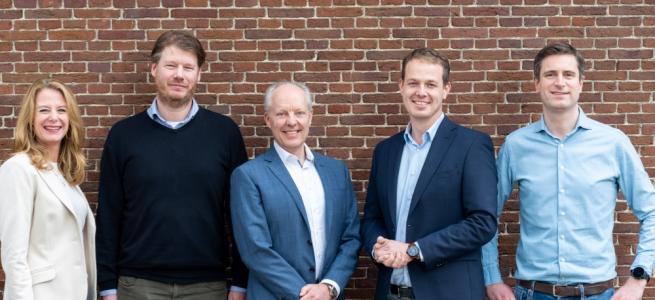

Capcora acted as exclusively mandated financial advisor for CSI. BonelliErede acted as lender legal advisor.

Francesca Nuccioni, Director at Capcora, comments: “Assisting Thomas and his team in successfully securing these funds has been a pleasure, as it enables the company to make a significant step forward toward achieving the planned growth. This mezzanine financing structured as a bond is a great example of multi-level structured funding solutions with international lenders having strong appetite in the Italian market. It underscores the importance of cross-border collaboration in a market with substantial growth potential facing long-term liquidity challenges. This transaction serves as a valuable blueprint for larger transactions of similar nature in Italy.”

Thomas Stetter, CEO at CSI, added: “This is the final step in the financing our Coversol 1 portfolio. We thank ETIC for the professional and efficient collaboration during the preparation of this mezzanine finance and look forward to finance also our upcoming portfolios with them, to be able to incorporate 300 MW of photovoltaic industrial rooftop projects into the Italian grid until 2027.”

Gabriel Delmer, Investor Director at ETIC, comments: “In many ways this transaction is a significant milestone: it initiates a strong partnership with CSI, who did an outstanding work on this project, while strengthening our presence on the PV rooftop market, very much sought after for its limited environmental footprint, and confirming our interest in Italy.