Rapid Capital Deployment Delivers Continued Growth

NextEnergy Capital, a global renewables manager specialised on the solar+ infrastructure sector, is pleased to highlight the significant momentum underlining its latest international OECD Fund, NextPower V ESG, having rapidly deployed capital across three large utility-scale solar portfolios in the past three months. The investment team are due to announce over 100MW of further acquisitions in Europe within the month and further projects are expected to reach investment committee stage in Q4.

NPV ESG’s portfolio has been built out at pace, with four high-quality acquisitions totalling an installed capacity of 464MW across the US, Spain, and Poland. NPV ESG also has a further 506MW of assets under advance negotiation across Europe and the US in various project stages and 68MW under exclusivity in Italy.

NPV ESG’s most recent acquisition was a binding agreement to acquire a 248MW portfolio of 12 under construction and ready-to-build solar PV projects in North-Eastern Spain, which marked the fourth investment and comes just after the recent closing of a long-term debt financing for an operational portfolio managed by NPV ESG’s predecessor Fund NextPower III ESG in the same region. NPV ESG’s other recent acquisitions include a 100MW under-construction solar project in the USA, as well as two operational CfD portfolios of 50MW and 66MW in Europe.

| Asset | Country | No. of Projects | Size (MW) | Technology | Project Stage | Revenue |

| 1 | US | 1 | 100 | Solar | Under Construction | Contracted |

| 2 | Poland | 66 | 66 | Solar | Operational | CfD |

| 3 | Poland | 52 | 50 | Solar | Operational | CfD |

| 4 | Spain | 12 | 248 | Solar | Under Construction | PPA |

The successful rapid deployment of capital is partially due to NEC’s expertly sourced pipeline through its vast network as the leading specialist solar+ investment manager in its key target geographies allowing NPV ESG to leverage NEC’s existing relationships in a derisked approach. Since the launch of NPV ESG, NEC has evaluated over 88GW of pipeline with 18GW of high-quality, attractive investment opportunities identified for more detailed evaluation.

NPV ESG's first operational assets are underpinned by a disciplined contracted revenue model structure with robust, credit-worthy counterparties enabling the Fund to benefit from long-term stable cashflows. NPV ESG leverages NEC’s track record of successful investments in the solar+ infrastructure sector since 2007, with over 460 utility-scale projects acquired and previous Funds delivering superior financial returns to investors.

NPV ESG has secured $745 million (including $150 million for co-investments) in total commitments with investors ranging from a UK LGPS investment pool and a Dutch pension fund, alongside re-ups from existing NextPower III ESG investors, including KLP, a German occupational pension fund, and a large Nordic pension fund. NextEnergy Capital continues to build on its positive fundraising momentum with a number of investors around the globe currently in due diligence and anticipates further strong closes later this year as the team continues to raise towards NPV ESG’s target of $1.5 billion.

NPV ESG is classified as an Article 9 Fund under the EU SFDR providing tangible and measurable impact including biodiversity measures. Upon reaching its investment ceiling and delivering c.4-5GW, NPV ESG is forecasted to generate enough clean energy to power the equivalent of up to 1.1 million households per year and avoid an estimated fossil fuel consumption of up to nearly 220 million m3 of natural gas annually.

NPV ESG’s investment strategy targets the solar+ infrastructure sector in carefully selected OECD markets, with the objective of building significant portfolios in each target market, creating value with a hands-on approach, establishing an operational track record and divesting the portfolio before the end of the Fund’s life in 2033.

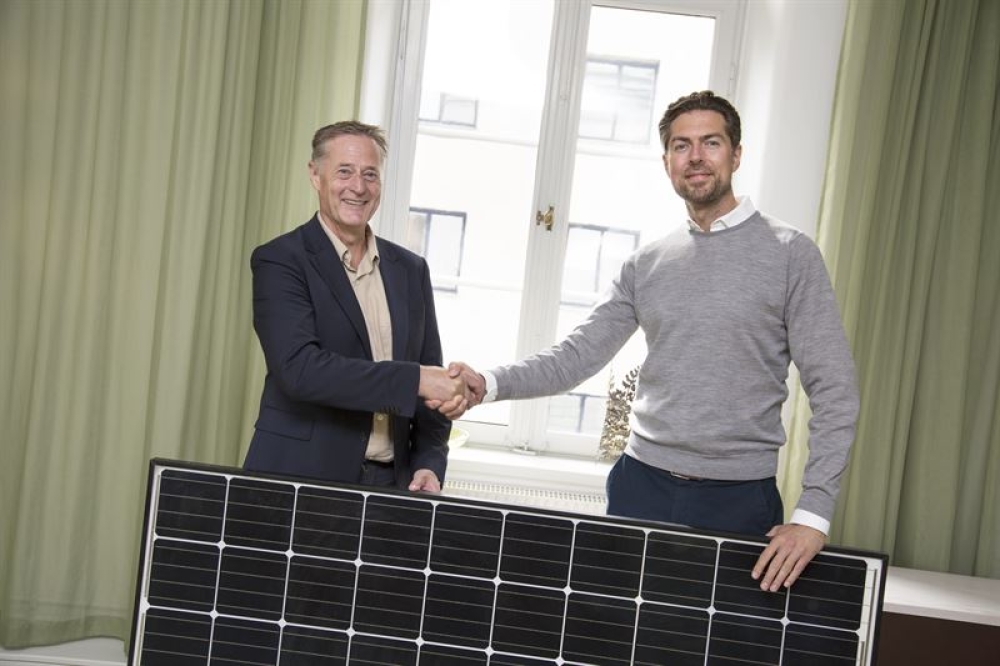

Michael Bonte-Friedheim, CEO and Founding Partner of NextEnergy Group, said:

“We are very pleased with the positive progress made across NextPower V ESG. The rapid deployment of capital into high-quality assets in various project stages is a testament to the skill set and experience of the NextPower V ESG investment team, having evaluated over 88GW of pipeline with 18GW of high-quality, attractive investment opportunities identified for more detailed evaluation. Our target geographies are regions we have been present in over a long period, and as a result are extremely familiar with the specific market conditions. NextPower V ESG is our flagship international Fund that continues to showcase NextEnergy Capital’s exemplary track record of portfolio growth and positive fundraising momentum.”

Shane Swords, NextEnergy Capital Managing Director and Global Head of Investor Relations, quoted:

“Investors continue to seek a specialist investment manager with a proven track record of successful delivery, deployment, and superior return generation, and we are thrilled that our experience in solar, and vast opportunities in the solar+ sector continue to be recognised as the go-to investment manager in this field. We continue to build on our positive fundraising momentum with NextPower V ESG with several investors around the globe currently in due diligence, we anticipate further strong closes later this year and look forward to welcoming new investors into the Fund.”