ib vogt finances strategy to facilitate Asset Ownership

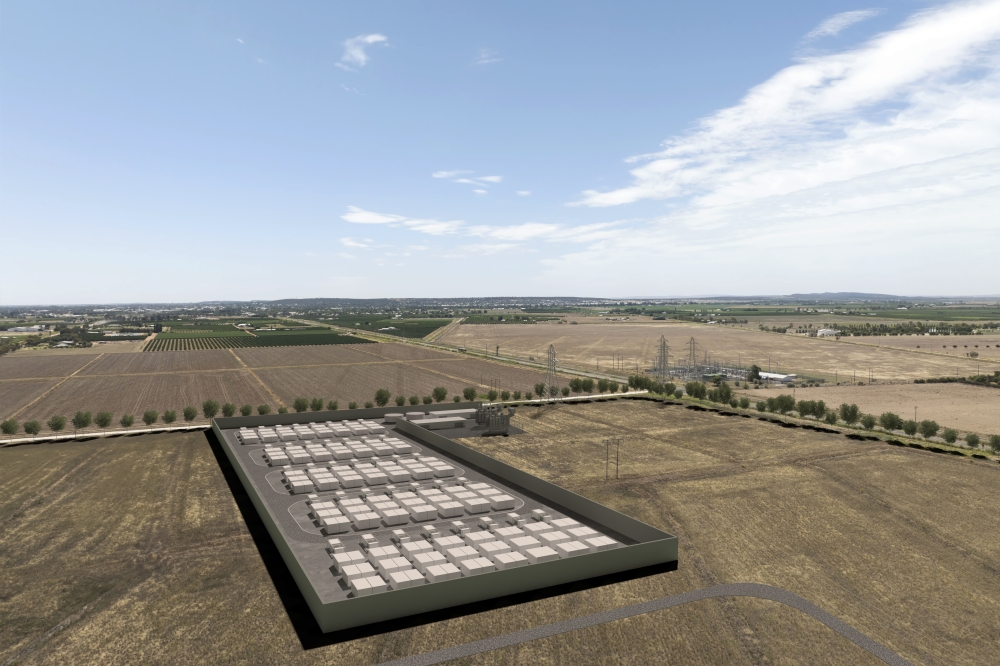

ib vogt has secured financing to establish a holdco loan facility for the purposes of acquiring a portfolio of ib vogt developed project companies that will develop own and operate a GW scale portfolio of international solar PV power plants throughout 2022 and beyond. The facility is being provided by a consortium of leading infrastructure institutional investors being BAE Systems Pension Funds; SCOR Investment Partners; and BNP Paribas Asset Management. The facility is sized at an initial EUR 120 million with an option to extend the loan by up to another EUR 150 million through an accordion mechanism. UniCredit Bank AG acted as Sole Bookrunner and Financial Advisor to ib vogt.

The facility is an integral element in ib vogt’s strategic objective of building a leading independent power producer platform (“IPP”) owning and operating solar PV and battery storage projects based on projects from the companies’ Development, EPC and O&M activities. This diversification will provide ib vogt with future value-adding opportunities including access to benefits from new revenue streams, cross selling, margin compression and asset optimization.

The IPP portfolio is expected to consist of projects from ib vogt’s global pipeline with focus on OECD markets including initial identified projects in France, Italy, Spain, Ireland, the UK, Poland, Hungary and Canada. The market conditions in these countries provide a low level of risk and have transparent and supportive regulatory regimes while experiencing strong demand for renewable energy. Most of the projects have already secured land, grid rights and other permits as well as offtake agreements and project financing. The pipeline contains some of the largest PV projects that have been developed in Ireland, Italy, Poland and Hungary to date. A number of these are currently in construction.

“Financing this portfolio is an important component of our IPP strategy and build up. We expect strong benefits and synergies between the current business focus and the IPP business extension, not least in that we are able to guarantee a high-quality, high-performance supply of projects into our IPP activities – that has at times been a challenge for IPP operators sourcing projects externally. We’ve enjoyed a great relationship with our financing partners and UniCredit and are looking forward to deploying this capital and delivering these projects,” says Anton Milner, CEO of ib vogt.

“We are proud to have advised ib vogt in this latest phase of growth, which will see the company take concrete steps to become a leading IPP. The transaction underscores our commitment to providing tailored financing solutions for the renewables build-out across Europe. We look forward to continued collaboration with ib vogt in the future,” says Youssef Fahd, Head of Infrastructure and Power Project Finance Germany at UniCredit.

ib vogt was advised by UniCredit (Sole Bookrunner and Financial Advisor) and CMS (legal and tax). BAE Systems Pension Funds, SCOR Investment Partners and BNP Paribas Asset Management were advised by Baker McKenzie (legal) and Global Loan Agency Services (GLAS) will act as facility agent and security trustee.