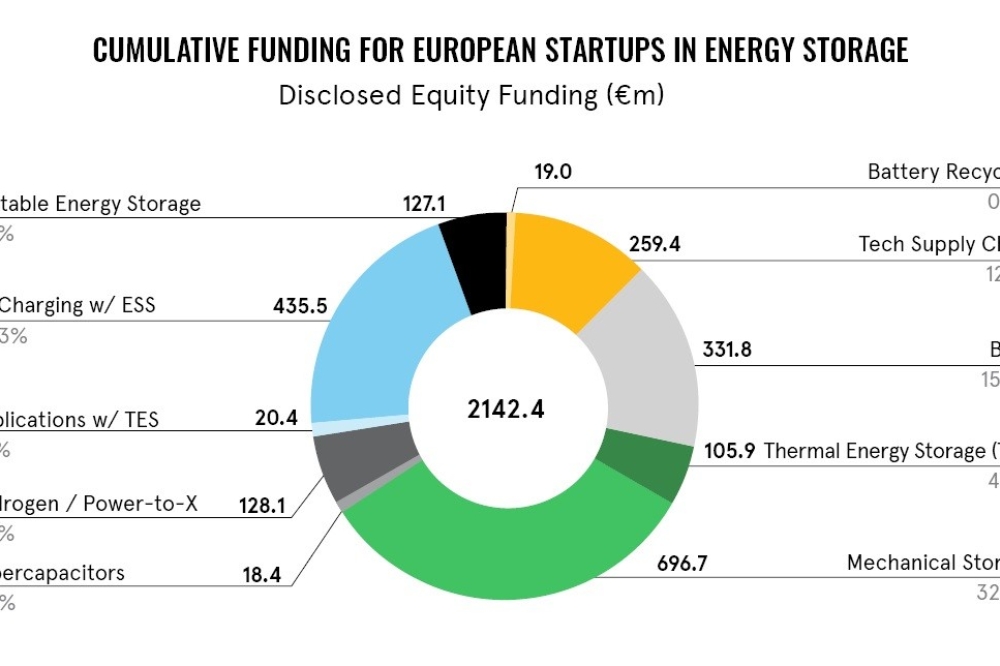

Funding for European energy storage startups reaches €2.14 billion

Total equity funding for European startups involved in the manufacturing of energy storage hardware (for commercial, industrial and grid-scale applications) has topped €2.14 billion. 46.7% of the €2.14 billion was raised in the last three years, and 84.4% in the last five, reveals new research from Avnet Silica.

€331.8 million in financial backing for BESS startups

The vast majority of private funding going into BESS is for Lithium-based batteries (€236 million in total), with €221 million allocated to the manufacture of Li-ion batteries and €15 million to lithium-sulfur technology.

Mechanical Storage is doing some heavy lifting with €696.7m raised

Mechanical storage has garnered the lion’s share of equity funding in the energy storage market, at €696.7m, more than double that of BESS (€331.8m), despite considerably fewer companies entering the mechanical storage space and fewer still reaching commercial maturity.

Thermal energy storage heats up with €105.9 million injection

€105.9 million in private funding is warming up the thermal energy storage (TES) market. €80.4 million has been invested in sensible heat storage, with companies storing heat in a variety of materials, including glass, ceramic, rock, gravel, and salt. A further €24.5 million of investment is helping to transform latent heat storage (phase change materials).

A little over €20 million has been raised by companies focusing on specific applications with in-built thermal storage – €4.9 million for manufacturers of industrial heat pumps with TES, €1.1 million for solar and TES combinations and €14.5 million for refrigeration with TES.

Supercapacitors, hydrogen and power-to-X draw in €146.5 million

Rounding out the range of energy storage providers, €18.4 million has been raised by companies producing supercapacitors, €73.7 million has been invested in companies developing hydrogen energy storage, and a further €54.4 million has been allocated to those offering power-to-x energy storage. This specifically refers to companies promoting hydrogen and power-to-X as a form of energy storage, rather than solely as a means of fuel production.

EV Charging with in-built energy storage secures €435.5 million

Companies offering EV charging with in-built ESS (for off-grid and remote locations or battery-buffered high-power charging) have received €435.5 million in funding.

Three European startups have secured a total of €127.1 million in funding for their portable energy storage solutions, aiming to power the events industry, construction sites, and other use cases.

Quarter of a billion filling up the energy storage supply chain

Over quarter of a billion in funding (€259.4 million) has gone into startups specifically focused on the energy storage supply chain, 78% of which has been funnelled into two particular areas – next gen battery chemistry (€113.2 million), and the production of cells & modules/packs (€89.0 million).

Recycling startups raise €19m to bring the process full circle

With a boost for the circular economy, two companies have raised money for battery recycling – Luxembourg's Circu Li-ion taking in €4.5 million and Germany’s tozero gathering €14.5 million.

This is in addition to the 14 BESS startups promoting the use of second-life batteries in their product line (some exclusively, and others as an available option).

Harvey Wilson, Senior Manager Industrial Vertical Markets EMEA at Avnet Silica, comments:

“While there are some well-established players leading the way in energy storage, it’s exciting to see startups offering solutions to the multitude of energy storage challenges that exist within different industries.

"There’s the challenge of EV charging in locations that can’t be easily powered by the grid. There’s a need for portable energy in temporary locations, such as events and construction sites. There’s a demand for industrial heat, which largely relies on fossil fuels at present. And beyond battery storage, there’s the issue of long-duration energy storage, the predominant solution for which is currently pumped hydro; however, other options are being developed and offered to the market as well.

"It’s also exciting to see startups focusing on the next-generation of materials, components and battery chemistry. The major suppliers of power electronics are also investing heavily in R&D, and we’re seeing lots of innovative technologies coming down the pipeline, enabling the next wave of power products, with higher performance and greater efficiency in energy storage, which will definitely be required if we’re to meet the demands of renewable energy, AI data centres, electrified industries, and our collective climate targets.”